In 2026, usage based insurance is reshaping how consumers and insurers think about risk, pricing, and fairness. Traditional insurance models relied heavily on generalized assumptions such as age, location, and historical averages to determine premiums. While effective in the past, these models often failed to reflect individual behavior accurately. Today, advancements in data analytics and connected technology are enabling insurers to assess risk more precisely. As a result, usage based insurance is gaining widespread adoption by offering personalized pricing that aligns premiums with actual usage patterns.

This transformation is closely linked to the rise of insurtech, which blends technology with insurance services to improve efficiency and transparency. By collecting real-time data through connected devices and mobile apps, insurers can better understand customer behavior. For drivers, this means safer habits are rewarded, while low-usage customers no longer subsidize higher-risk individuals. The growing popularity of usage based insurance reflects a broader shift toward fairness, flexibility, and data-driven decision-making in financial services.

How Pay as You Drive Models Work

One of the most popular forms of usage based insurance is the pay as you drive model. This approach calculates premiums based on how often and how far a person drives rather than relying on static assumptions. Drivers who use their vehicles less frequently or drive shorter distances typically pay lower premiums. This model is especially appealing in urban environments where alternative transportation options reduce daily driving needs.

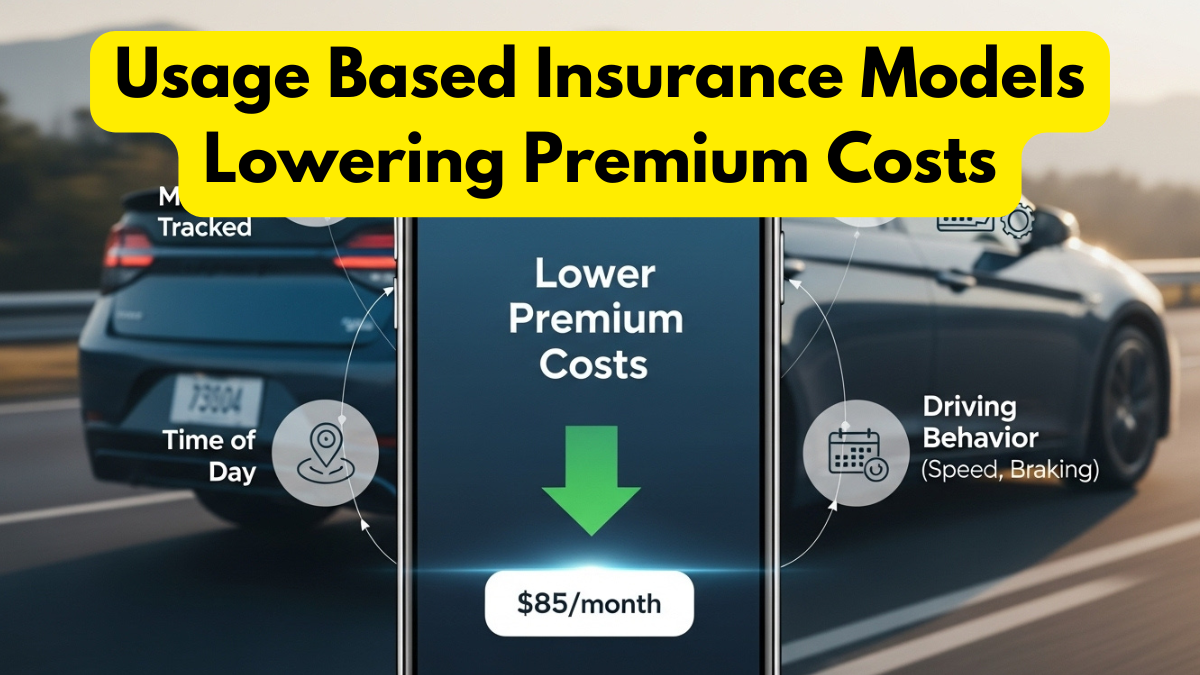

The pay as you drive system relies on telematics technology to track mileage and driving behavior. Data is collected through in-vehicle devices or smartphone applications and analyzed to determine risk levels. This transparency empowers consumers to understand how their actions influence costs. By encouraging mindful driving habits, usage based insurance not only reduces premiums but also promotes safer roads and more responsible vehicle use.

The Role of Insurtech in Personalized Insurance

The rapid growth of insurtech has been a key enabler of usage based insurance. Advanced data analytics, artificial intelligence, and cloud computing allow insurers to process vast amounts of behavioral data in real time. This technological foundation supports dynamic pricing models that adapt to changing usage patterns, making insurance more responsive and customer-centric.

Through insurtech, insurers can also offer user-friendly dashboards that display driving scores, mileage summaries, and premium forecasts. These insights help customers make informed decisions about their coverage and habits. As usage based insurance evolves, insurtech continues to drive innovation by improving accuracy, reducing administrative costs, and enhancing the overall customer experience.

Benefits of Usage Based Insurance for Consumers

The appeal of usage based insurance lies in its clear and measurable benefits for consumers. By aligning premiums with actual behavior, these models create opportunities for cost savings and increased transparency.

Key benefits include:

- Lower premiums for low-mileage and safe drivers

- Greater control through pay as you drive pricing

- Real-time feedback enabled by insurtech platforms

- Increased fairness compared to traditional models

- Encouragement of safer and more sustainable driving habits

These advantages make usage based insurance particularly attractive to young drivers, urban residents, and individuals with flexible travel patterns. As awareness grows, more consumers are viewing behavior-based insurance as a smarter alternative to fixed-rate policies.

Comparison of Traditional Insurance and Usage Based Insurance

The table below compares conventional insurance models with usage based insurance, highlighting why behavior-based pricing is gaining momentum.

| Aspect | Traditional Insurance | Usage Based Insurance |

|---|---|---|

| Pricing Basis | Demographics and averages | Real-time usage data |

| Premium Flexibility | Fixed | Dynamic and adjustable |

| Driver Control | Limited | High through pay as you drive |

| Technology Use | Minimal | Advanced insurtech tools |

| Cost Transparency | Low | High and data-driven |

This comparison shows how usage based insurance delivers greater fairness and adaptability. By leveraging insurtech, insurers can offer models that better reflect individual risk profiles.

Impact on Sustainability and Future Mobility

Beyond cost savings, usage based insurance supports broader sustainability goals. The pay as you drive model encourages reduced vehicle usage, which can lower emissions and traffic congestion. As cities promote shared mobility and alternative transportation, insurance models that reward lower usage align well with future mobility trends.

Looking ahead, insurtech innovations are expected to expand behavior-based insurance beyond vehicles. Similar models may apply to health, property, and device insurance, creating a more holistic and responsive insurance ecosystem. As data privacy and transparency improve, consumer trust in usage based insurance will continue to strengthen, paving the way for widespread adoption.

Conclusion

In 2026, usage based insurance is redefining how premiums are calculated by prioritizing fairness, transparency, and real-world behavior. Through flexible pay as you drive models and advanced insurtech solutions, consumers gain greater control over their insurance costs while insurers benefit from more accurate risk assessment. This approach not only lowers premiums for responsible users but also promotes safer and more sustainable habits. As technology continues to evolve, usage based insurance is set to become a cornerstone of modern, customer-focused insurance systems.

FAQs

What is usage based insurance?

Usage based insurance is a pricing model where premiums are determined by actual usage and behavior rather than fixed demographic factors.

How does pay as you drive insurance lower costs?

Pay as you drive insurance lowers costs by charging drivers based on mileage and driving patterns, rewarding low usage.

Is usage based insurance safe for data privacy?

Most insurtech providers use secure systems and transparent policies to protect customer data and ensure privacy.

Who benefits most from usage based insurance?

Low-mileage drivers, safe drivers, and urban residents benefit most from usage based insurance models.

Will usage based insurance replace traditional insurance?

While traditional insurance will remain, usage based insurance is expected to grow rapidly as consumers seek personalized and fair pricing models.

Click here to learn more